This week on the What is The Future for Cities? podcast, we witnessed a fascinating collision between the “relentless logic of the real estate market” and the personal, almost spiritual, identity of the places we call home. We explored (episode 401R) whether spending public billions on pumps and sea walls is a sound investment or simply “throwing money into the ocean,” through a research debate based on the article “Adaptation infrastructure and its effects on property values in the face of climate risk” by David L. Kelly and Renato Molina. We then sat down with Ben Gilliland, from Future Proof Property Intelligence, to discuss why “future-proofing” is no longer an optional luxury—it is a forced change (episode 402I).

As we wrap up this week’s exploration, five key lessons stand out that every homeowner, city planner, and investor needs to understand to navigate the shifting tides of the 21st century.

1. The market rewards resilience (eventually)

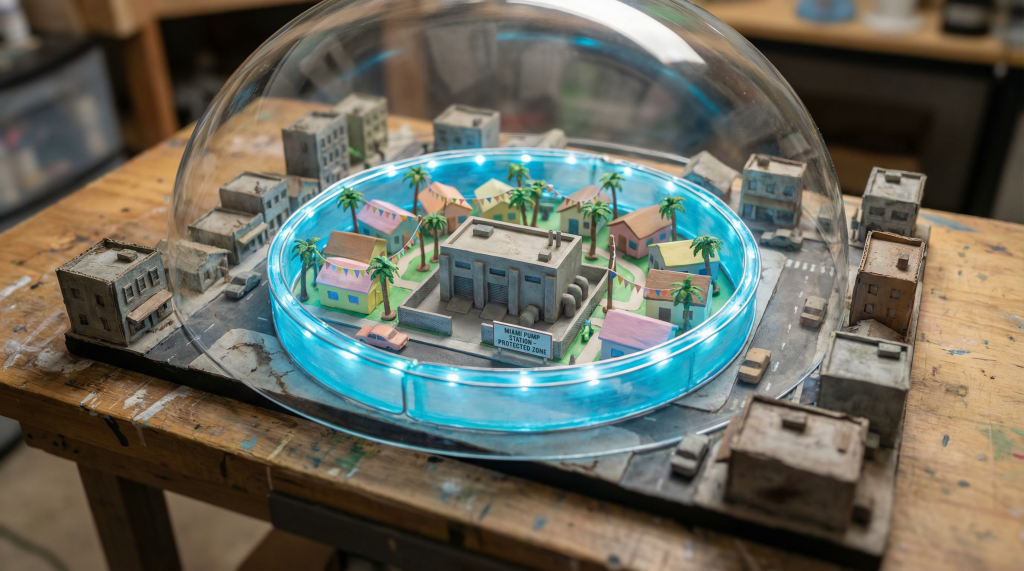

The first big takeaway comes from the rigorous data analyzed by David L. Kelly and Renato Molina in Miami-Dade County. Skeptics often argue that climate risk is too abstract for the market to price accurately, but the research proves otherwise. When local governments invest in adaptation infrastructure—like drainage, pumping stations, and sea walls—the market responds with a “resounding economic success”.

Properties near these projects don’t just hold their value; they appreciate. The study found a clear signal: prices rise approximately 10% five years after a project is completed. This suggests that while real estate is an illiquid market that takes time to “permeate” with new information, buyers and sellers eventually recognize that a house that stays dry is worth more than one that doesn’t.

2. The “200-meter rule” and the limits of infrastructure

While the economic benefits of adaptation are real, they are also incredibly localized. This week’s research highlighted what we might call the “200-meter rule”. The data shows that price benefits are concentrated intensely within just 200 meters of a project boundary. Move just a block or two away, and the price effect simply “evaporates”.

This serves as a critical reminder: physical infrastructure is basin-specific. A pump on one street cannot save a basement ten blocks away. Furthermore, these projects are often “marginal improvements” designed to handle nuisance flooding and high tides. As the study notes, these interventions are unlikely to protect against the extreme sea-level rise predicted for the long term. Infrastructure buys us time, but it does not necessarily stop the fundamental crisis.

3. Moving from fear to “alchemy”

In our interview with Ben Gilliland, we moved beyond the numbers into the psychology of change. Ben introduced the concept of “alchemy” as a way to understand the transition cities are facing. For Ben, alchemy isn’t just technology; it is the process of how people become conscious of a problem and shift their consciousness to solve it.

We are currently at the end of an 80-year industrial cycle that began with mass production and rural-to-urban migration. We are entering a new cycle that Ben predicts will be “exciting, thrilling, depressing, and scary” all at once. To survive this shift, we have to move past the “hopelessness” of climate change and focus on “actionable outcomes”.

4. Your home is personal, not just an asset

One of the most profound moments of the week was the shift in how we view residential property. In the real estate market, a house is often treated as a “piggy bank” or a financial asset. But Ben Gilliland challenged us to view it as a “personal identity” and a “sanctuary”.

“If you care about yourself, then you’re going to have to care about your home,” Ben noted. This personal connection is a major driver for adaptation. When we realize that our homes are the “embodiment in brick and mortar” of who we are, the motivation to protect them from “heat islands” and “supercharged storms” becomes urgent. This is why Ben’s platform, Future Proof, focuses on the homeowner—because you cannot fix a city without fixing the root of where people live.

5. Preparation is a “force multiplier” for the future

Finally, we learned that time is our most precious resource, but “time only exists in the present”. Denial is a luxury we can no longer afford because “denial is not a plan”. Ben’s message was a modern-day “Paul Revere” cry: the storms are coming, and we must prepare now.

Preparation involves a “house doctor” approach—diagnosing the maladies of a building and prescribing remedies, from “DIY options” to “automated re-engineering”. Whether it is using AI-driven tools like the “Magic Window” to see the climate risks of the year 2100 or understanding that “nuisance flooding” destroys value immediately, the lesson is clear: those who prepare today will be better positioned to preserve their wealth and safety tomorrow.

As we navigate the “uncharted waters” of urban evolution, we are currently creating “tiny islands of value in a sea of risk”. Public infrastructure can stabilize the market and provide the tax base necessary for cities to remain solvent. But it is the combination of public investment and personal responsibility—a digital “barn raising” of the modern era—that will ultimately determine the future of our cities.

We don’t have a magic wand to fix the global climate overnight. But we do have the data to prove that adaptation works, and we have the tools to make our homes resilient. The question is:

Will we sit back while the water rises, or will we become fearlessly committed to the alchemy of change?

Next week we are investigating how behavioural science could help create better urban futures with Jeff Siegler!

Share your thoughts – I’m at wtf4cities@gmail.com or @WTF4Cities on Twitter/X.

Subscribe to the What is The Future for Cities? podcast for more insights, and let’s keep exploring what’s next for our cities.

Leave a comment